The Sales Tax is a single-stage tax which is imposed at import and production levels. Sowill the SST cause prices to increase.

Malaysia Sst Sales And Service Tax A Complete Guide

Youll find everything you need to know about SST.

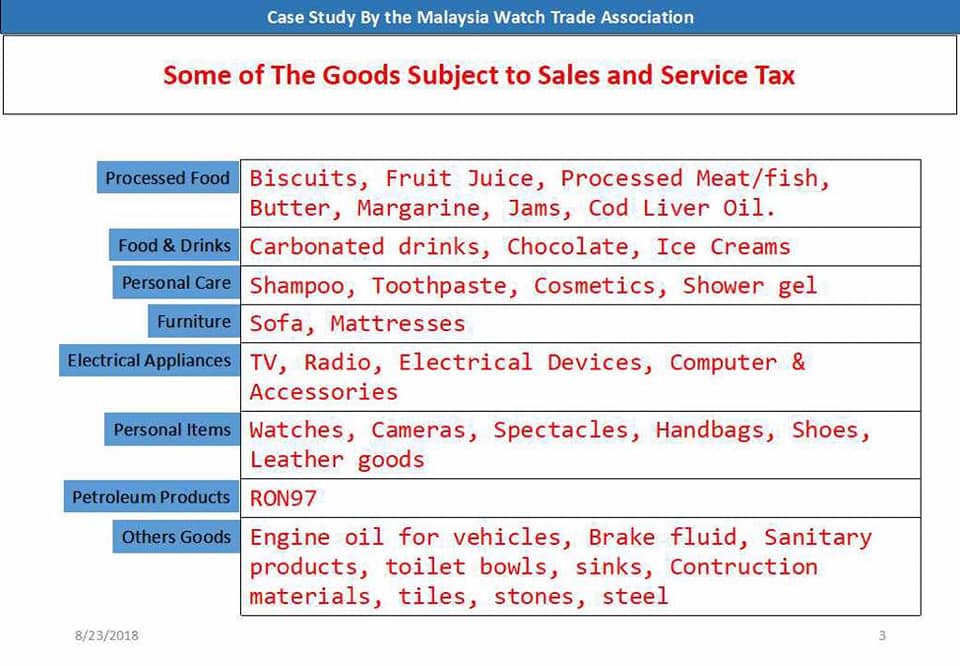

. With SST fewer items are taxable whereas under GST almost all items except for the essentials were taxable. When it comes to the selling of products and services in Malaysia the government has implemented it. Within a 12-month period any person who does subcontract work in the manufacture of taxable items and whose total costs for work completed exceeds the stipulated threshold of RM500000 is.

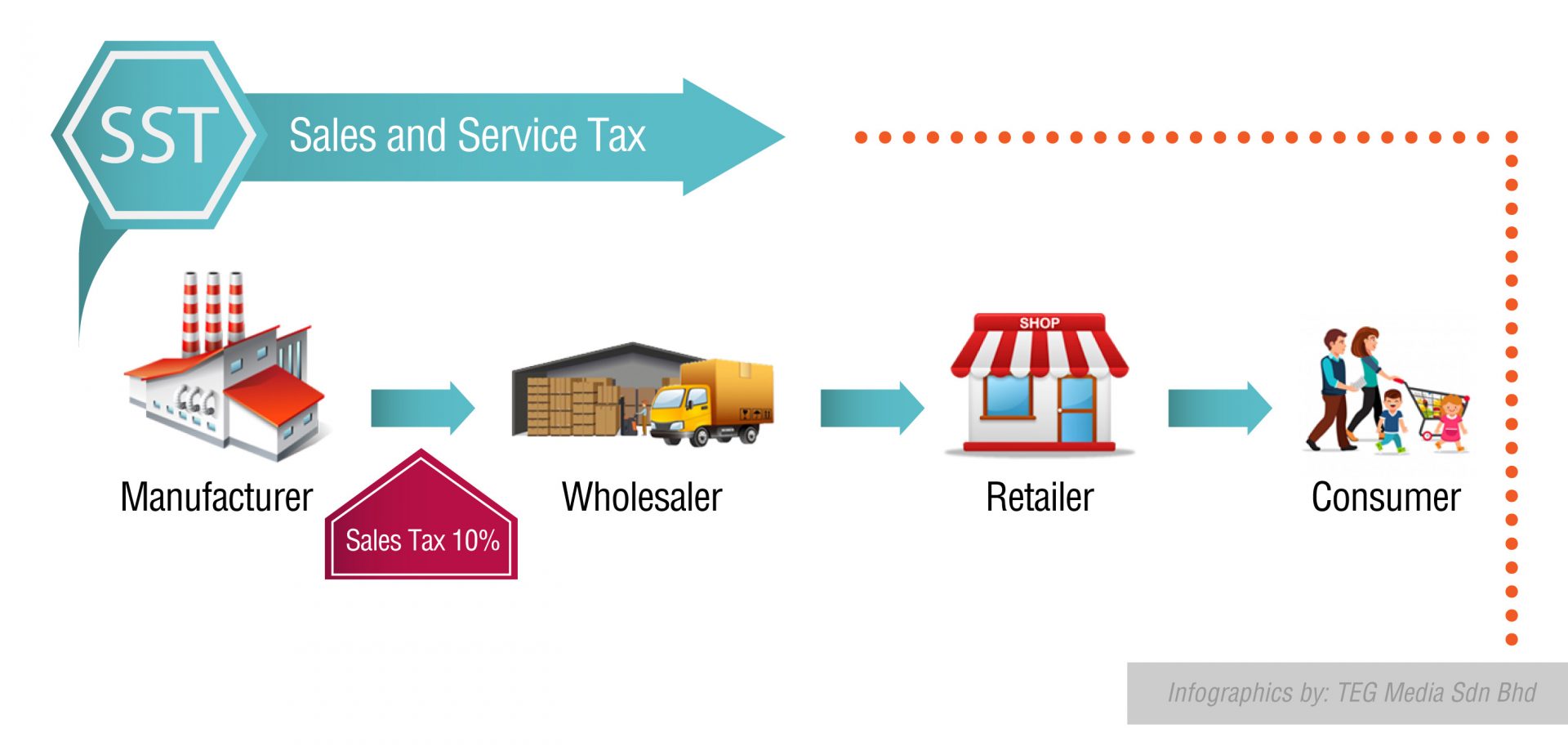

The SST consists of 2 elements. The standard rate of tax. It is a single-stage tax which means that an amount is charged on taxable goods which are manufactured and sold by any taxable person s in the country.

SSTs criticism and disadvantages are as follows-. It has certain classification issues. It is an indirect tax since it is not paid by companies.

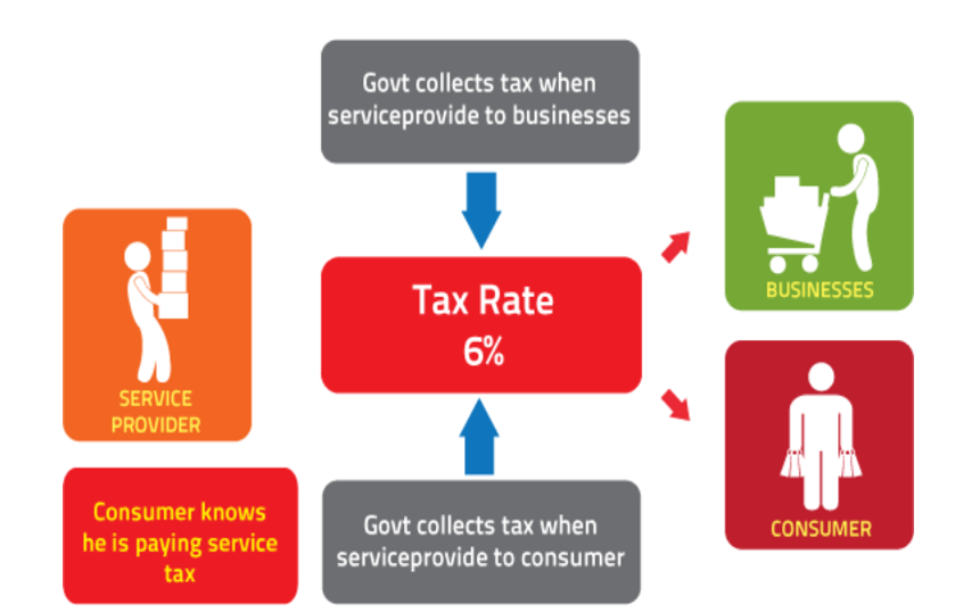

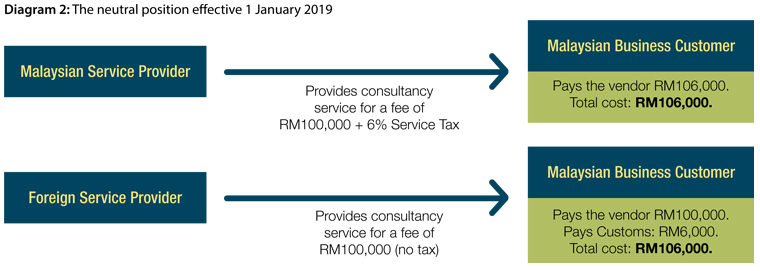

Sales and Service Tax SST is a tax charged and levied on taxable services provided by the taxable person. The invoice would be paid in full in July 2019. SST in Malaysia and How It Works.

The service tax of RM6000 being 6 of RM100000 is due on 10 March 2019 being the earlier of date of payment and receipt of invoice. Exempted from SST registration are tailoring jewellers and opticians. Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax.

This is certainly a muddy question to answer but lets try. The Services Tax is an indirect tax which is imposed on any taxable service which has been provided by a taxable individual in Malaysia and was provided in the name or with the approval of a company. Service tax that is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business.

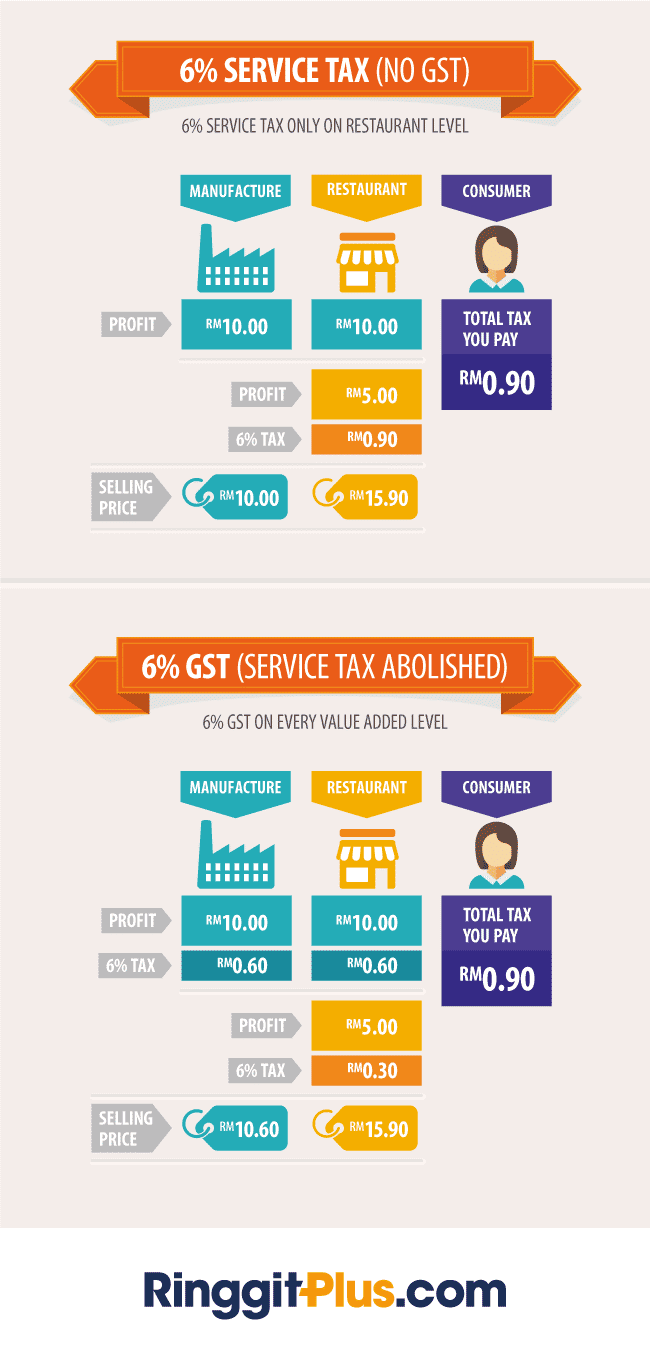

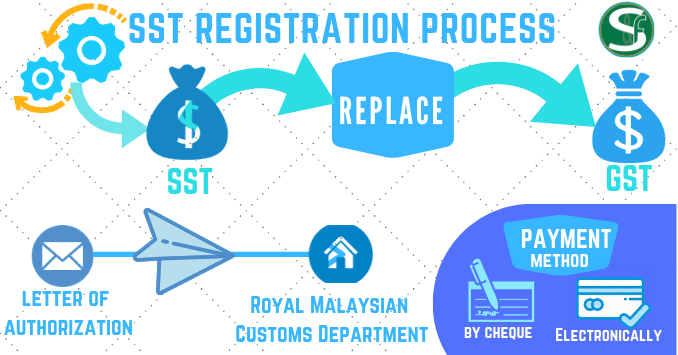

Malaysias new Sales and Service Tax or SST officially came into effect on 1 September replacing the former Goods and Services Tax GST system and requiring Malaysian businesses to adjust to a new regime. 2How does service tax works. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax.

Rather it is charged to consumers through the price of goods and collected by enterprises. Service tax is a tax charged on-. Manufacturers who carry out sub-contract work on taxable goods where the value of work performed exceeds RM500000 in a 12 month period are liable for Sales Tax.

Move the mouse over the button to open the dropdown menu. Taxable person is any person who belongs in Malaysia and is prescribed to be a taxable person. Made in the course or furtherance of any business.

It took the place of the 6. This new tax regime has caused some businesses uncertainty as well as money. The service tax rate will be 6.

Any provision of taxable services. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be registered for the tax which is levied at rates varying from 5 to 10 depending on the goods in question. Malaysias indirect sales tax SST was reinstated on September 1 2018 replacing the previous sales and service tax SST.

The businesses that perform their activities in Malaysia and internationally will have to pay SST if they exceed a particular annual income threshold. Businesses in Malaysia have a relatively short period in which to adjust to the new process so its best they work with a local. Certain supplies are treated as zero-rated.

The new sales tax will be imposed at a rate of either 5 10 or a specific amount will be for petroleum products. 1What is Service Tax. It is either imposed during the time of importation or goods disposal or sales.

By a taxable person. Service tax a consumption tax levied and charged on any taxable services provided in Malaysia by a registered service provider in carrying out their. If XYZ Sdn Bhd is service tax registered the service tax of RM6000 must be included in the service tax return for the taxable period March to April 2019.

The threshold for operators of restaurants cafes bars canteens or any food and beverage business is subject to RM 1500000. A What is Service Tax. A single tax levied on imported and locally made goods.

Broad-based levied on all goods and services including imports unless specifically excluded Levied on all locally manufacturedimported goods and certain prescribed services. 3Who is the taxable person. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come into effect in 1 September 2018.

SST was reinstated on 1 September 2018 the tax. Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia. SST causes cascading and compounding effect.

Contents hide 1. Goods and Services Tax GST Sales and Service Tax SST Multi-stage tax. However SST works separately as Sales Tax and Service Tax.

The SST is charged to the manufacturer and consumer and there are no tax credits. Taxable service is any service which prescribed to be a taxable service. Sales and service tax sometimes known as SST is a sort of consumption tax.

Malaysia Sales and Service Tax SST is a consumption tax imposed on a wide range of goods and services. While most countries are moving to GST Malaysia reverted back to SST even though many believe it to be a less progressive form of tax. The current threshold is set at an amount of RM500000.

Sst Vs Gst How Do They Work Expatgo

Sales And Services Tax In Malaysia

Tax Only A Few Issues To Iron Out With Sst Say Experts The Edge Markets

Sst Simplified Malaysian Service Tax Guide Mypf My

Sales And Service Tax Malaysia 2020 Onward Sst Malaysia

Malaysian Taxation The Tasks Ahead For Sst Asia Research News

Malaysia Sst Sales And Service Tax A Complete Guide

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Sst Vs Gst How Do They Work Expatgo

Gst Rates In Malaysia Explained Wise

What Is Sst Its Impact Datatree Solutions

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Malaysia Sales And Services Tax Sst Mwta